COVID-19 Research

How have US industries responded to the 2020 COVID-19 pandemic shock?

Tip: Choose which industries you wish to display.

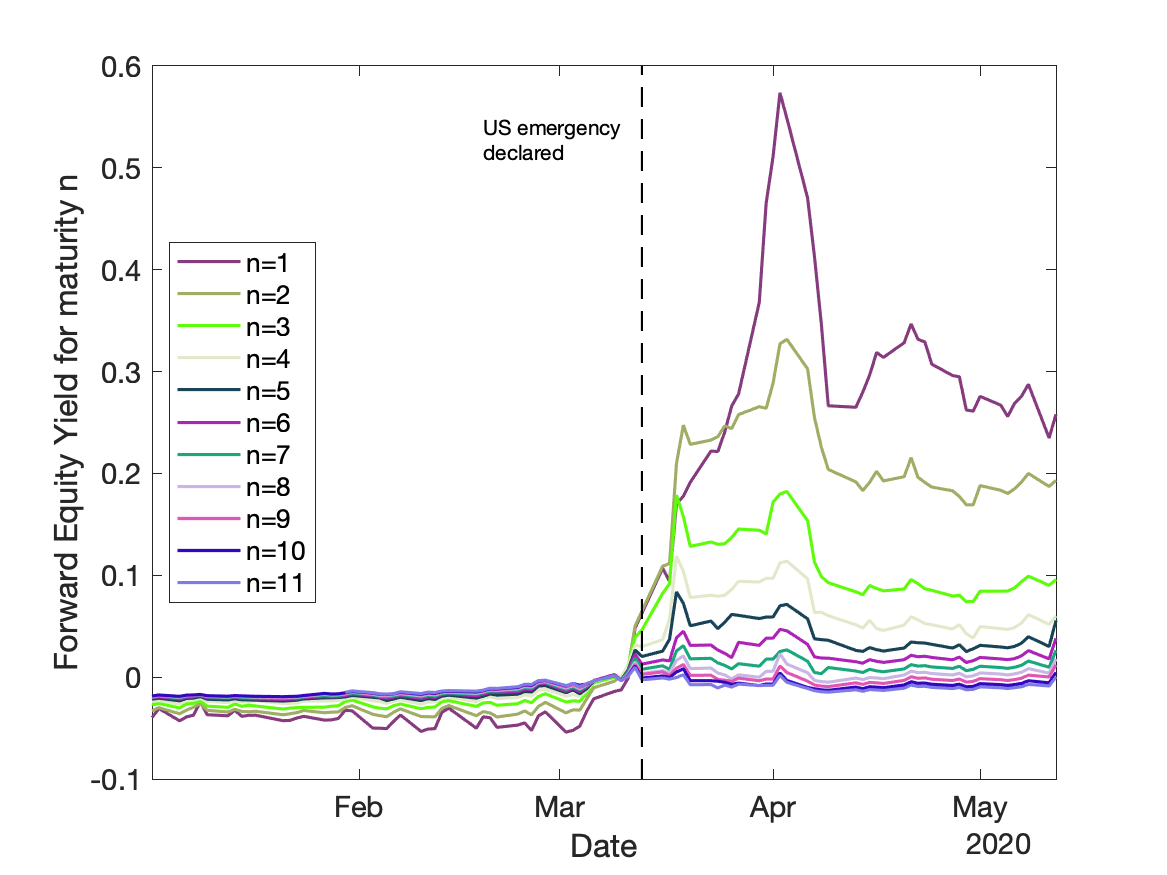

Term Structure of Equity Premia inverted in mid-March 2020 after the US declared national emergency.

Finding:

Industries with the highest level of cash-flow risk performed the worst.

Duration-based explanation:

Industries with high cash-flow risk have lower average dividend growth

Fama French 30 Industries

Description:

- Cash-flow Risk = Long-term Covariance between Dividend Share and Aggregate Consumption Growth (1929-2018), the displayed level is 1000x larger

- Equity Term Structure estimated using S&P 500 Dividend Futures data from CME

- Excess Return = Average Daily Excess Return (January - March 2020)

- CAPM beta = CAPM beta estimated using daily excess returns (January - March 2020)

- Annual Dividend Growth = Long-term Average Annual Dividend Growth (1929-2018)