Working Papers

Asset Pricing with the Awareness of New Risks

with Christian Heyerdahl-Larsen and Philipp Illeditsch

SSRN Working Paper Latest update: February 2025

Highlights:

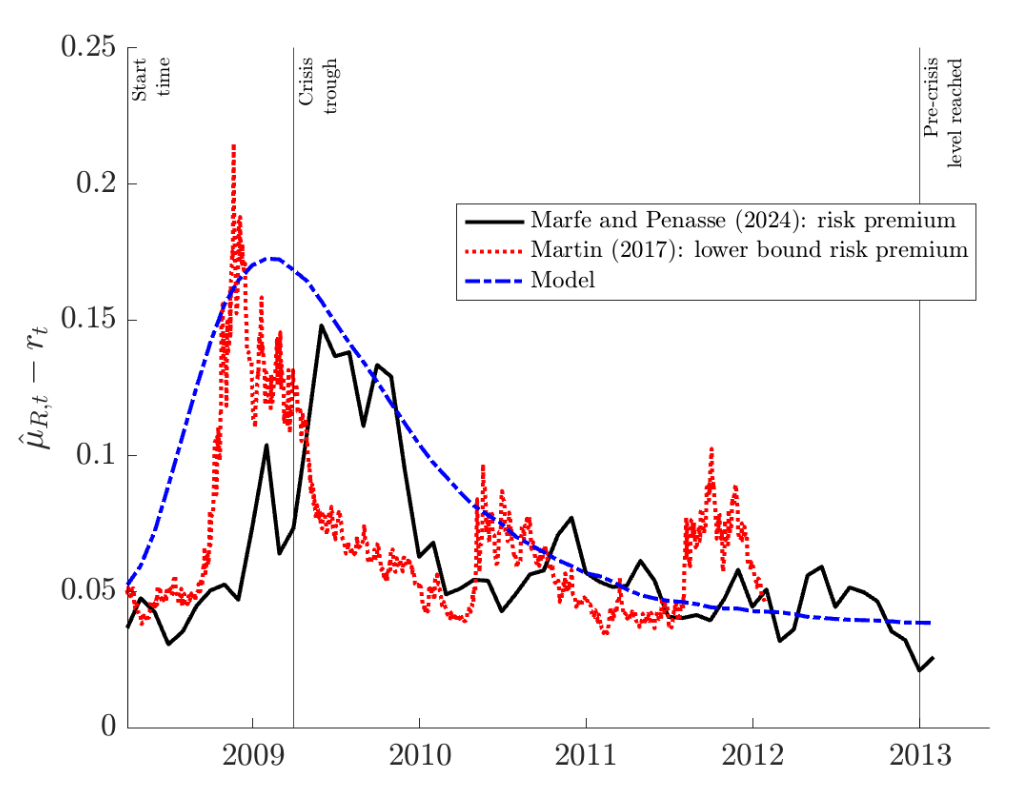

- We propose a new asset-pricing model designed to fit output data during recessions.

- A recession follows after the introduction of a new risk source.

- The model implies a hump-shape patterns of risk premia and return volatilities during crises.

- We show that this hump shape shows up in data.

Presentations: 2025 Annual Conference of the Swiss Society for Financial Market Research*, EasternFA 2024, CUHK-RAPS-RCFS 2024, NFA 2024, CICF 2024, 8th Young Scholars Finance Consortium, MFA 2024, FIRS 2023, 6th World Symposium on Investment Research, University of British Columbia, University of Iowa

The Response of Equity Yields to a Long-Run Shock

with Martijn Boons, Anthony M. Diercks and Andrea Tamoni

SSRN Working Paper Latest update: February 2025

Highlights:

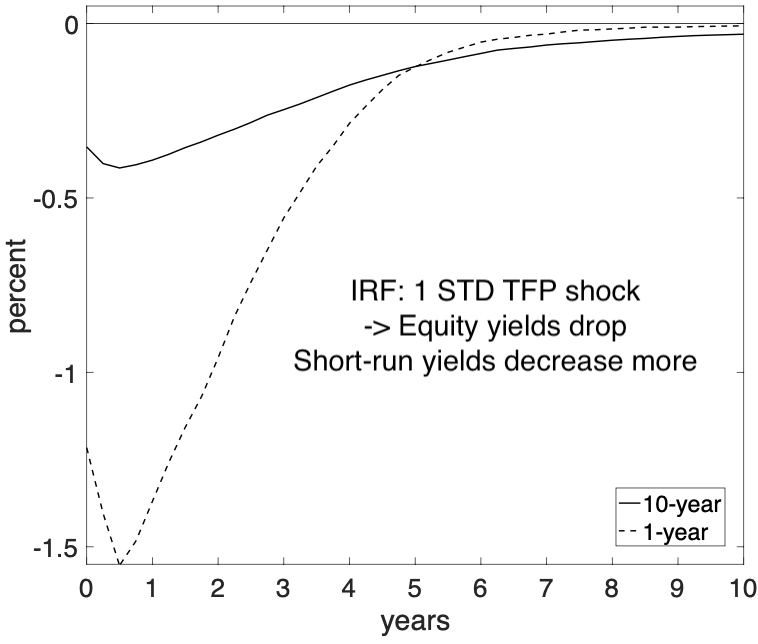

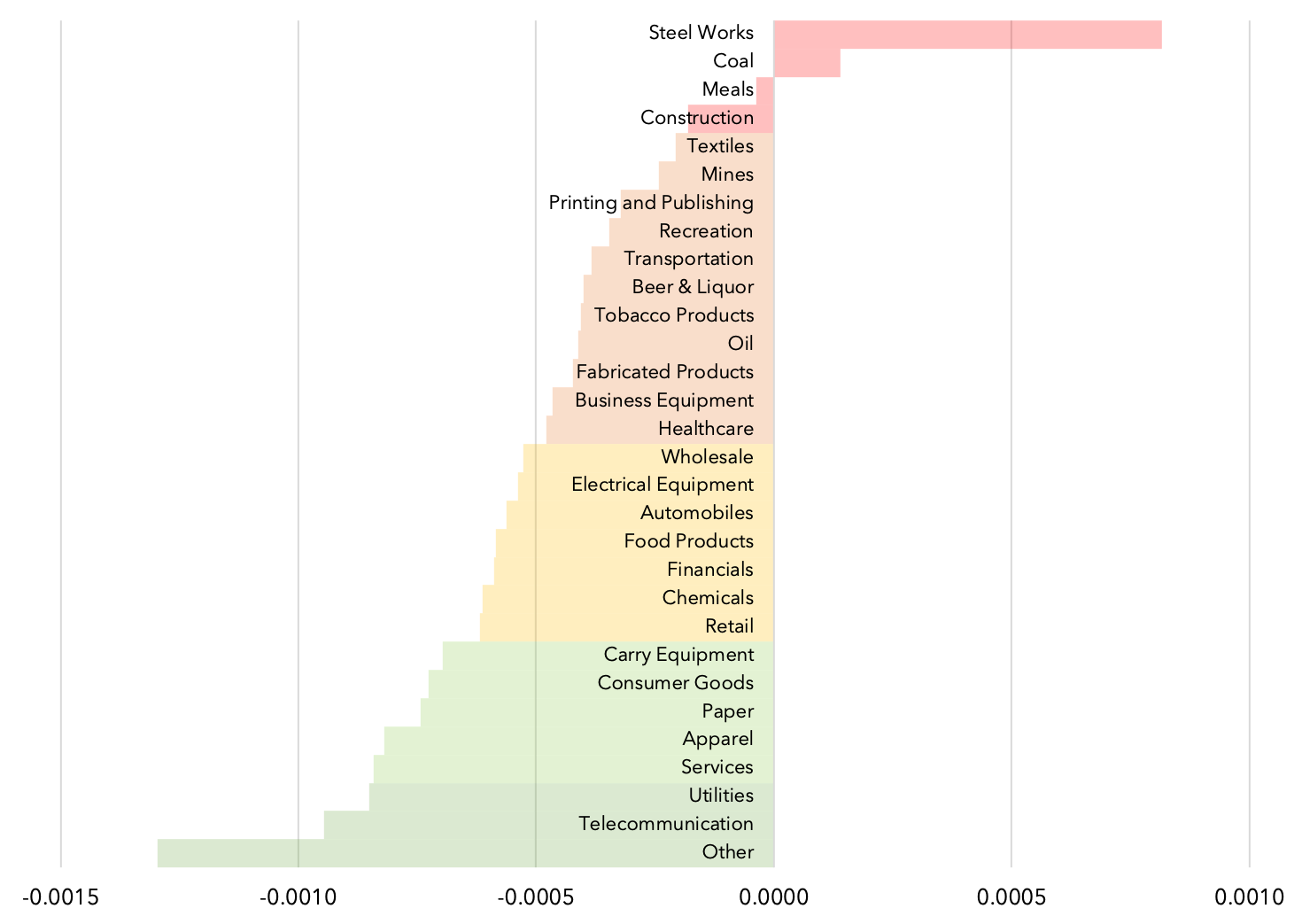

- We study how macroeconomic developments influence asset prices through equity yield responses.

- A positive long-run (TFP) shock steepens the equity yield curve.

- It increases short-term yields more than long-term yields.

- This is driven by an increase in short-run expected dividend growth.

- Risk premia are mostly unaffected.

- We highlight differences in responses between growth and value firms, and between cash payouts and total firm payouts.

- The production-based model of Ai et al. (2018) better explains these dynamics than standard equity term structure models.

Presentations: CICF 2024, 2024 Annual Conference of the Swiss Society for Financial Market Research, EasternFA 2024, University of Iowa, 2023 Econometrics Mini Conference

The Learning Channel in Asset Pricing: Firm-Level Evidence

with Kewei Hou

Working Paper Preliminary Draft: February 2025

Highlights:

- New Predictive Factor: Expected change in profitability forecasts returns beyond existing factors.

- Return Spread: Sorting by expected profitability change yields a 0.3% monthly return spread.

- Learning and Asset Prices: First structural estimates of firm-level learning effects on returns.

- Earnings-Based Approach: Predictions rely only on quarterly earnings, not stock prices.

Presentations: BI Norwegian Business School (scheduled)

Who Gains, Who Loses? Speculation, Stock Market Participation, and Wealth Inequality

with Christian Heyerdahl-Larsen and Philipp Illeditsch

First draft coming soon

Highlights:

- This paper studies how financial speculation affects non-investing households.

- Speculation, driven by output disagreement, does not alter their consumption share.

- Non-participating households miss the equity risk premium, limiting wealth accumulation.

- Disagreement raises asset price volatility but does not increase household consumption volatility.

- Financial exclusion, not speculation, is the key driver of wealth inequality.

Presentations: University of Iowa (scheduled)

Uninformed but Predictable: Corporate Trading and Price Discovery in Over-the-counter FX Markets

with Umang Khetan

SSRN Working Paper Updated version coming soon

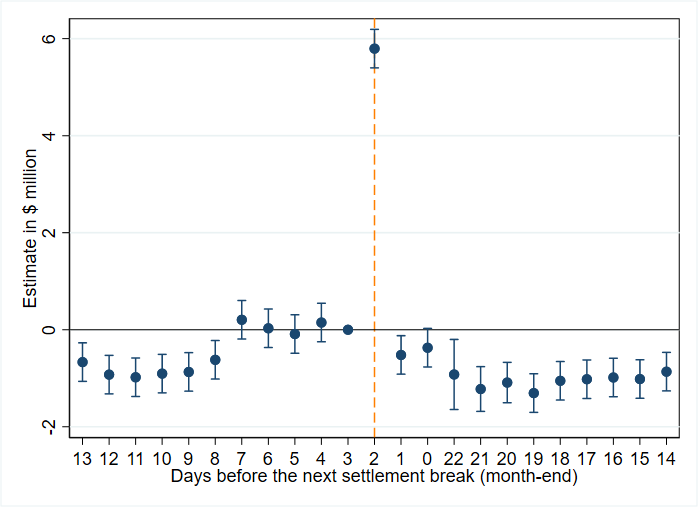

Highlights:

- We measure liquidity shocks experienced by non-financial corporations trading FX using month-end settlement breaks.

- One standard-deviation increase in corporate trading volume due to liquidity shocks substantially increases the overall return volatility.

- Corporate liquidity shocks also increase dealer-to-dealer trading volumes and client-level spreads.

Presentations: WFA 2022, 2023 AFFECT Mentoring Workshop, 17th Central Bank Conference on the Microstructure of Financial Markets, 4th Future of Financial Information Conference, University of Iowa, 2021 FMA New Ideas Session

Uncertain firm profits and (indirectly) priced idiosyncratic volatility

with Xuhui (Nick) Pan and Bharat Raj Parajuli

SSRN Working Paper Latest update: February 2024

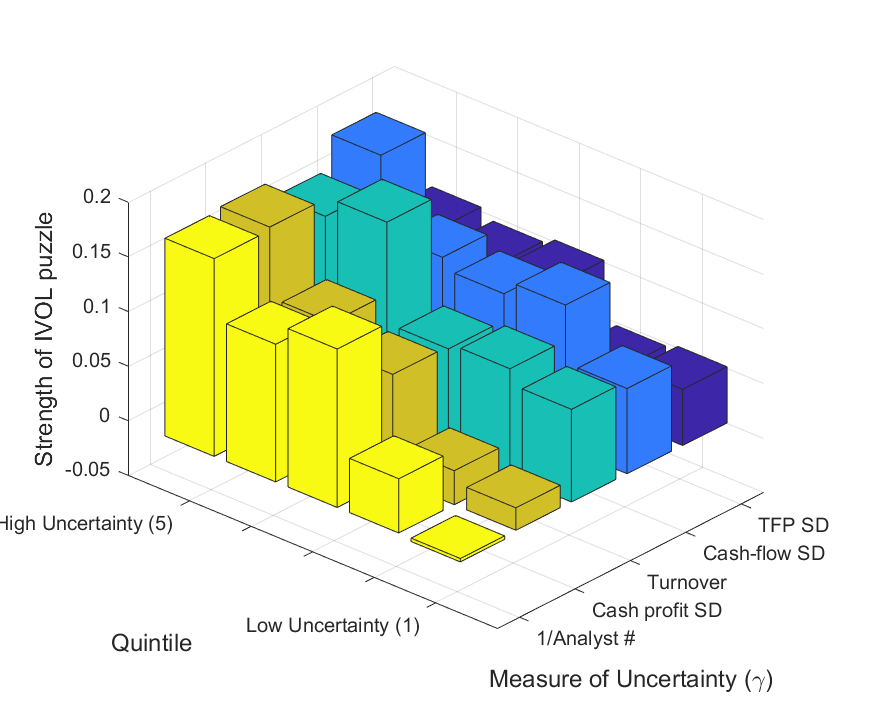

Highlights:

- The negative relation between idiosyncratic volatility (IVOL) and expected returns exists only among firms with low profitability and high uncertainty about profitability.

- We propose a theory where agents cannot disentangle systematic from idiosyncratic shocks that rationalizes this phenomenon.

- High idiosyncratic noise lowers signal accuracy, which decreases the factor loading on the priced systematic risk and yields the negative IVOL-return relation.

- As found in data, the model predicts the negative relation to be the strongest among underperforming firms with highly uncertain profitability.

Presentations: University of Iowa, University of Oklahoma.

Preference Shocks and Contemporaneous Cash-flow Risk

SSRN Working Paper Latest update: November 2020

Highlights:

- I propose a theory with preference shocks and contemporaneous cash-flow risk designed to explain asset-pricing patterns related to business cycle.

- Contemporaneous cash-flow risk of equities drives the cross section of risk premia in bad times.

- In this model, empirically-observed quantities of contemporaneous cash-flow risk have a significant effect on conditional risk premia of assets and return volatility.

Presentations: MFA 2020, Oxford Finance Job Market Workshop 2019, 31st AFBC, 9th FMCG, EFMA 2018, Macquarie University, University of Iowa, Melbourne University, Aarhus University, NOVA University, Vrije University

Recessions, Bank Distress & Managerial Incentives to Innovate

with Jiawei (Brooke) Wang

SSRN Working Paper Latest update: February 2024

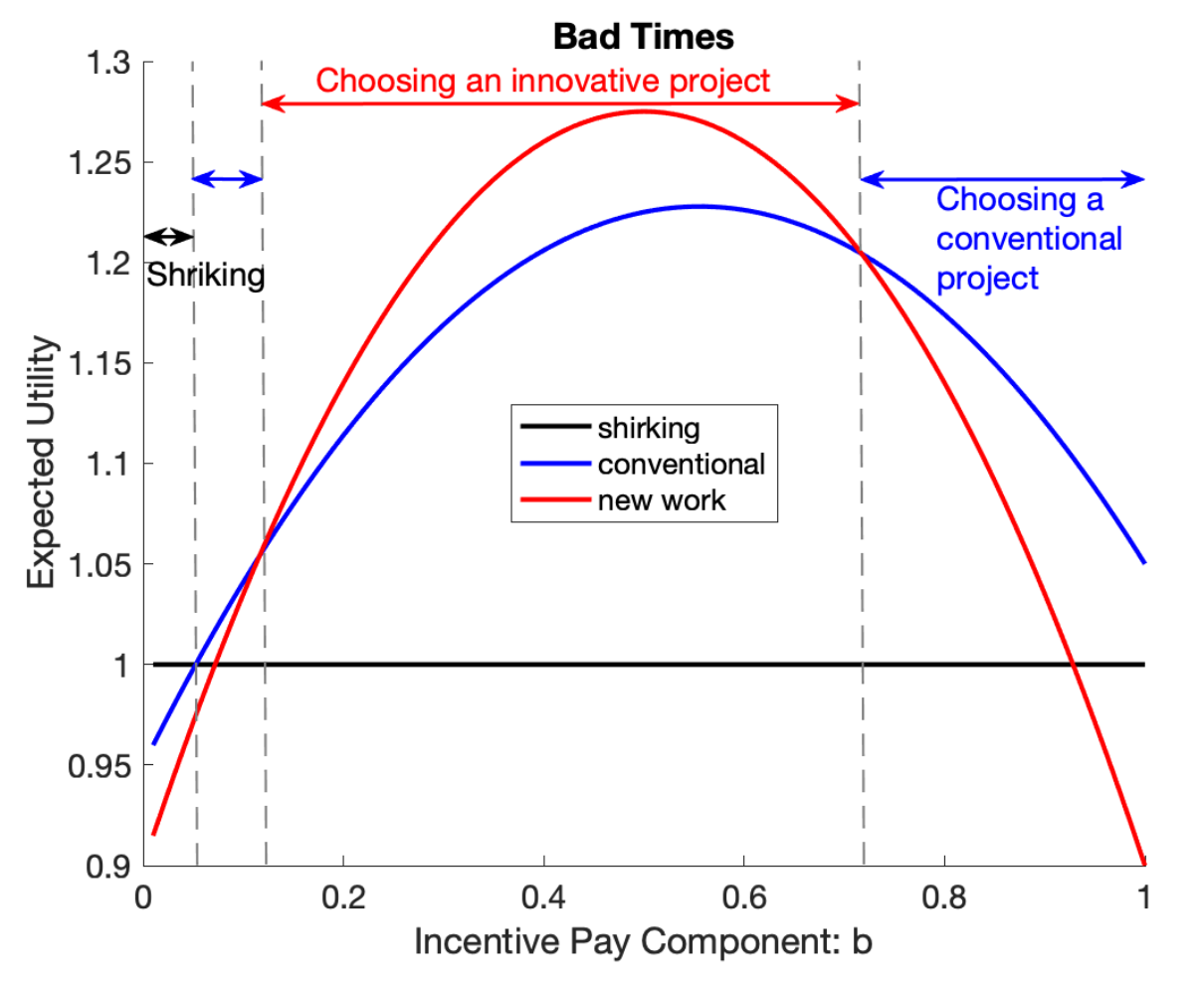

Highlights:

- More CEO option pay awarded in bad times lead to firms producing more patents in future.

- We measure shocks to CEO option using identified multi-year option plan, following Shue and Townsend (2015).

- Risk-averse managers are choosing to innovate more in bad times, which is when conventional projects are riskier due to the overall higher systematic risk in markets.

- Not all firms can effectively leverage these incentives: the effect is found only among financially unconstrained firms with higher Z scores.

Presentations: 6th Erasmus Corporate Governance Conference, Silicon Prairie Finance Conference 2023, 28th Finance Forum, University of Iowa